Stop Overpaying the IRS - Webinar #4

by Dylan Williamson | Oct 16, 2025 | automotive, accounting, bookkeeping | 0 Comments

If you wait until tax season to think about taxes, you're already behind — and it's costing you more than you think. In our latest webinar, Redline Business Advisors’ President Nancy Williamson and CEO Dylan Williamson break down how proactive tax planning can save shop owners thousands before the year ends.

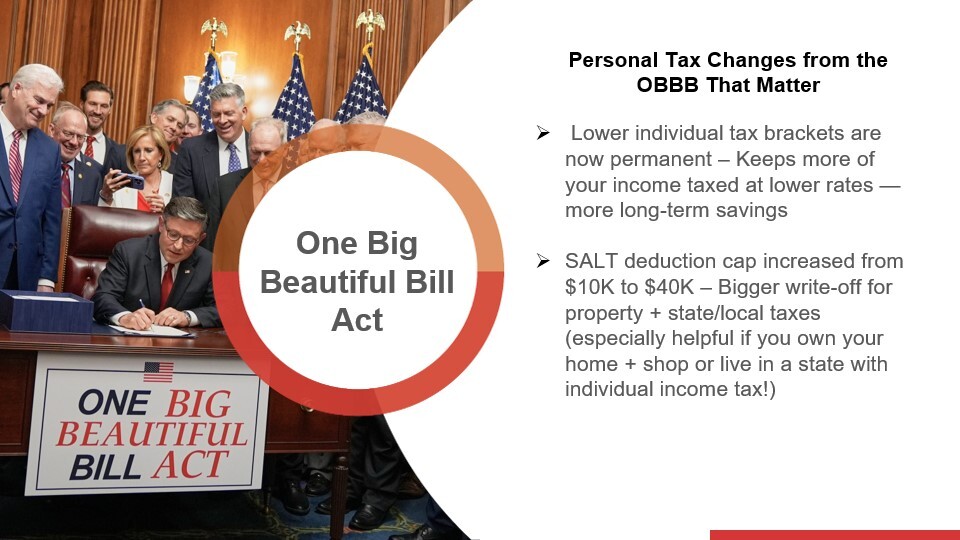

This isn’t about scrambling in April. Nancy and Dylan walk through the real strategies successful shops use year-round to reduce their tax burden, plan smarter purchases, and take advantage of major updates from the One Big Beautiful Bill Act passed in 2025.

The conversation is practical, direct, and packed with takeaways you can act on now — not months from now.

Here’s a look at what we cover in our latest webinar:

- Why reactive tax planning leads to overpaying the IRS

- Simple ways shops accidentally give up deductions

- How to time equipment and vehicle purchases for maximum benefit

- What the “One Big Beautiful Bill” really means for small businesses

- Using Profit First to make tax-saving automatic instead of stressful

- Mileage deductions and vehicle write-offs — what actually works

- Making the most of your 401(k) as an owner

- Smart deductions vs. common mistakes

If you want to stop overpaying, keep more of what you earn, and plan with intention instead of panic, this webinar is a must-watch.

Catch the full conversation and start winning the tax game before the year is over.

Submit a Comment

Your email address will not be published. Required fields are marked *